Capital Strategy Insights: Reimagining The Process #009

04.22.2022

#009 Strategic Capital Planning – Asset Values Over Time

In Post #007 we touched on developing a strategic approach to capital procurement and spend. One of the considerations for the strategy included prioritization, a topic we will address soon. Post #008 looked at an overview or top-down perspective that will guide the strategy development. But before moving on to prioritization, I thought I would offer another overview perspective on average asset values.

When you collect data at level that MERC does you see some things that I think are interesting and valuable. One data point that we have looked at over time is the average value of an asset.

Before getting into numbers lets discuss what “assets” are in this measurement. Some of our customers have asset thresholds; for them we only evaluate assets with an acquisition value at threshold or above. Others include nearly everything from an MRI to kick buckets. Sometimes the valuation includes furniture and furnishings, sometimes IT, sometimes surgical instrumentation. The vast majority of the assets we value are in “used” condition. The care venues can vary as well, as we serve customers in nearly every venue of acute or non-acute care. The common thread is we only serve healthcare customers and 98% of the time they are care providers.

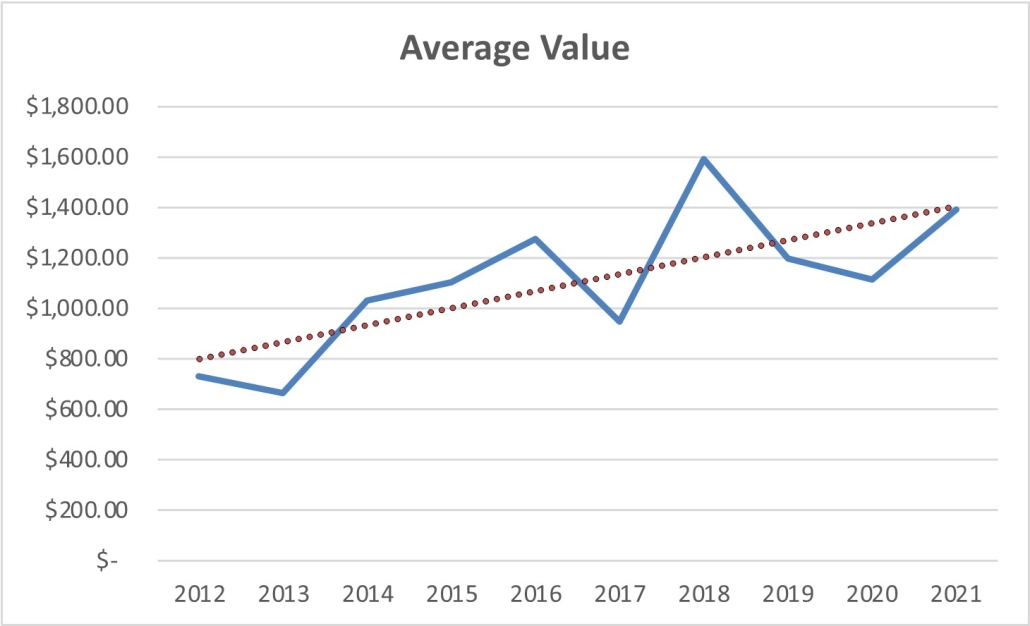

So, what you have here follows the law of big numbers for the assets we have valued. During the last 10 years we have appraised over 230,000 devices, so it is a large sample size. Let’s take a look at the trendline in the chart below:

Again, there are some variations to consider. Our appraisal volume dropped in 2013 (customers focused on EHR Meaningful Use) and 2020 (COVID), and 2018 had a bit more acute care and imaging contribution than most years; however, I think overall that this trendline illustrates what is happening to asset values in the market. Average asset values are increasing significantly. This is likely a reflection of prices paid when purchased; new prices appear to be pulling up used prices.

This has been an area I wanted to share with our readers for a while, and so I moved it up in the queue. The trend is more pronounced than we even thought before eyeballing the data. Glad I did it for both of our benefits.

Next post on metric-based prioritization – hope you will join us then. As always, feel free to comment at info@medicalequipmentconsultants.com.